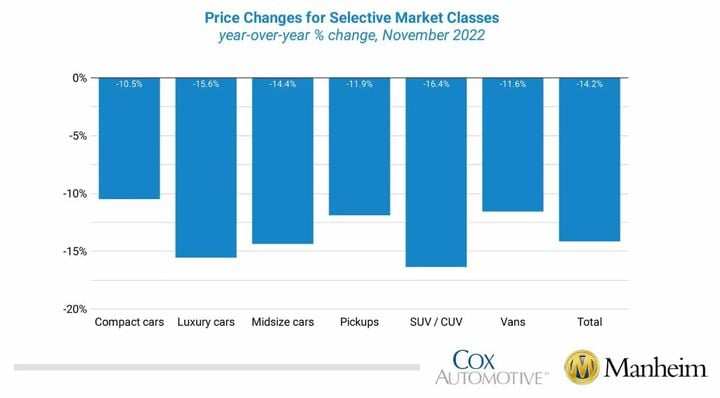

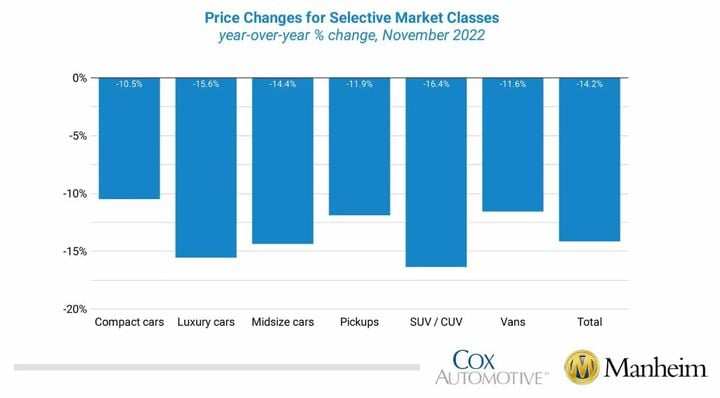

Wholesale Used-Vehicle Prices Down 14.2% in November YOY

significant market segments once again saw seasonally changed prices that were reduced year over year in November. Portable cars and trucks had the smallest decline at 10.5%, adhered to by vans as well as cars, both at 11.6%, and also pickups at 11.9%. The other 4 sectors’ prices were less than the market. Compared to October, 6 of eight major sections’ efficiencies were down. Full-size automobiles shed one of the most at 6.4%, followed by midsize autos at 1.1%. Four various other segments lost under 1%. Sports cars were up by 1.2% as well as pick-ups got 0.9%.

Made Use Of Retail Sales Estimates Declined in November

Leveraging a same-store collection of dealerships selected to represent the nation from Dealertrack, Manheim estimates that used retail sales decreased 1% in November from October which used retail sales were down 10% year over year. Contrasted to November 2019, sales were down 22%, which was an enhancement from October. Debt deals heavily influence the same-store data series, and also growth in cash purchase task is likely causing the quotes to decrease greater than real market sales.Using price quotes of made use of retail days’supply based upon vAuto data, November ended at 47 days’supply, down from 53 days at the end of October yet higher than exactly how November 2021 ended at 44 days. Leveraging Manheim sales and inventory data, wholesale supply is estimated to have finished November at 29 days, higher than how November 2021 finished at 24 days yet unmodified from the end of October.November’s complete new-light-vehicle sales were up 10.4 %year over year, with one more selling day than in November 2021. By quantity, November new-vehicle sales were down 4.2%from October. The November sales rate, or seasonally changed annual rate(SAAR ), can be found in at 14.1 million, a 7.9%increase from last year’s 13.1 million however down 6.5%from October’s 15.1 million pace.Combined sales right into big leasing, business, and also federal government fleets

were up 55 %year over year in November. Sales into rental fleets were up 127 %year over year, sales into business fleets were up 29%, and also sales into government fleets were up 15%. Including a price quote for fleet deliveries into supplier as well as maker channels, the remaining retail sales were approximated to be up 4.8%, resulting in an estimated retail SAAR of 12.5 million, down 0.3 million from last month’s rate, or 2.3 %, but up 0.9 million from in 2014, or 7.6%. The fleet share of 15.7%was up 1.6%from last month and was up 4.5% from last year.Rental Risk Prices Mixed in November The ordinary price for rental danger systems sold at public auction in November

was up 0.6%year over year. Rental risk prices were down 0.4%contrasted to October. Ordinary mileage for rental threat units in November( at 54,000 miles )was down 28.5 %contrasted to a year back and also down 4.3% from October.Measures of Consumer Confidence Were Mixed in November The Conference Board Consumer Confidence Index decreased 2%in November, and also the October index was additionally changed down. A lot of the index decline was driven by a 3.2%decline in views of future expectations. Plans to purchase a lorry in the following six months declined, eliminating the enhancement in October, however continued to be up year over year. The confidence index has not declined as a lot this year as the belief index from the University of Michigan, but that series likewise declined in November. The Michigan index decreased 5%, driven mostly by the views of current problems decreasing 10 %, while the expectations index was down only 1%. Customers’sights of buying problems for cars decreased modestly however stay far better than previously this summer. The day-to-day index of customer sentiment from Morning Consult measured boosting view in November, as that index was up 2.6%for the month. View enhanced in November past the mid-term elections and while the price of gas was up to its cheapest level since February. The nationwide ordinary price was$3.47 per gallon for unleaded gas at the end of November, according to AAA. Originally posted on Vehicle Remarketing

For GREAT deals on a new or used INFINITI check out Germain INFINITI of Easton TODAY!